If you are like many seniors, you are finding your retirement budget is not keeping up with the cost of living. It is making it more difficult to cover expenses, including those out-of-pocket costs for your prescription drugs. There is help available to those who qualify through Low Income Subsidy (LIS), also known as Extra Help.

How LIS/Extra Help Works

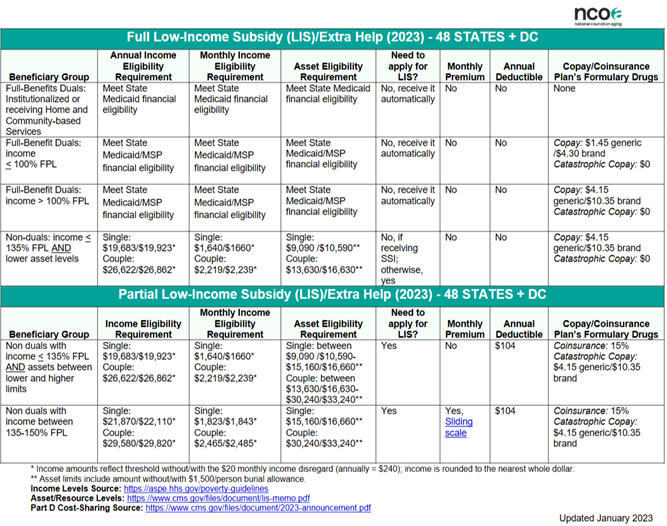

LIS/Extra Help is a financial assistance program administered through Social Security Administration (SSA). If you qualify it will help pay some or all of your prescription costs, including premiums, deductibles, and copayments. There are two levels of assistance, full or partial help. The savings can be a much as $5,300 per year. You must be enrolled in Medicare Part A and B to be eligible to apply.

You automatically qualify for LIS if you are eligible for full Medicaid, are enrolled in a Medicare Savings Programs, or if you receive Supplemental Security Income (SSI). Otherwise, you must meet income and asset requirements to be eligible.

2023 Income and Asset Requirements:

What Counts as Assets:

- Bank accounts (checking, savings, CDs)

- Cash

- Real estate not including your primary residence

- Stocks, bonds, mutual funds, and IRAs

Even if your income or assets exceed the requirements you can still apply. Some income and assets may not be counted, and you could still qualify.

LIS Application Process

There are several ways to apply for LIS through Social Security. You can apply over the phone at 1-800-772-1213, apply in person at your local SSA office, or apply online. You can apply once per year.

Within approximately three weeks of submitting your application, SSA will send you a decision letter letting you know if you are eligible, and if you qualify for full or partial benefits. If you are found eligible, you will receive benefits for at least the remainder of the year. If you qualify and aren’t enrolled in a Medicare Part D prescription plan, you will need to select a plan. The Part D late penalty, if applicable, will be waived.

Changes to Eligibility

There are a couple of ways you can become ineligible for LIS. If you no longer qualify for Medicaid, Medicare Savings Programs or SSI, you could lose your LIS benefits as well. If this happens, you will receive a letter from Social Security notifying you that you no longer qualify. Also included with the letter is an LIS application form. If you believe you still might qualify you should complete the application and return it ASAP so there is no lapse in your benefits.

SSA also regularly reviews LIS beneficiaries for eligibility. If this happens to you, you will receive a letter requesting you resubmit your current income and asset information. Once reviewed by SSA, you will receive notification of whether your benefits stayed the same, increased, deceased, or was denied entirely.

If your benefits are decreased or denied, and you disagree with the decision, you can file an appeal and request a hearing to have your case reviewed. There are two chances to file an appeal.

- When you receive the Pre-Decisional Notice – this is an explanation of why your benefits are being reduced or denied. If you disagree because the denial is based on inaccurate information you have 10 days to submit corrections.

- When you receive the Notice of Award – this is the final decision explaining whether you qualify for (full or partial) benefits or if you have been denied completely you will receive a Notice of Denial. If you disagree with the decision to reduce or deny your benefits, you can file an appeal by calling your local SSA office or the national hotline 1-800-772-1213.

If you need help understanding if you qualify for LIS, the team at Medicare Educators is here to help. Call us.